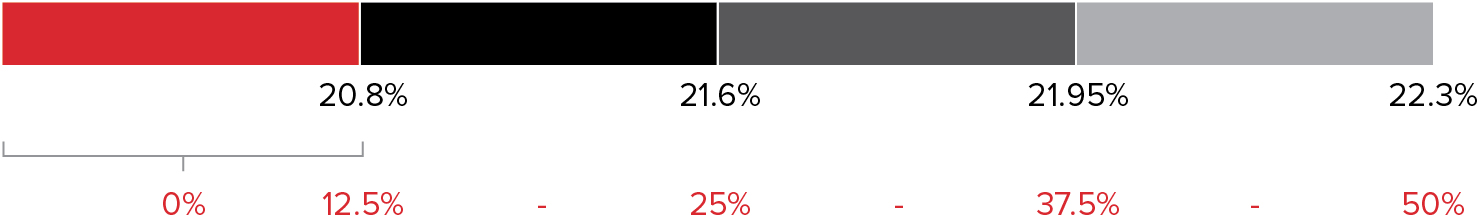

| 3-Year Average ROI |  | | % of PSUs earned for each metric | | | | | | | | | | | | | | | | | | | Threshold | Target | 150% Payout | Maximum | | | | | | | | | | | | 3-Year Relative TSR Percentile (1) | | | | | % of PSUs earned | | | | | | 06 | | | COMPENSATION DISCUSSION

AND ANALYSIS

| | | | | | | |

2020-2022 Performance Plan Awards

(1)Three-year Relative TSR vs the 2021 Compensation Peer Group companies for period of January 1, 2021 – December 31, 2023. In general, formulaic plans provide that the MDCC has discretionary authority to NEOsexclude unusual or infrequently occurring items, extraordinary items, and the cumulative effect of changes in accounting treatment when determining performance attainment where warranted by events and/or business conditions. 2021-2023 PERFORMANCE PLAN AWARDS TO NEOS The following table presents the number of Performance Stock Units granted to the NEOs for the 2020-20222021-2023 performance period, along with their respective grant date value: | | | | | | | | | | | | | NEO | Target # of PSUs (1) | Grant Date Value(2) | | Mr. Adamczyk | 35,300 | | | $ | 7,502,309 | | | Mr. Lewis | 11,100 | | | $ | 2,359,083 | | | Ms. Madden | 11,100 | | | $ | 2,359,083 | | | Ms. Dallara | 9,200 | | | $ | 1,955,276 | | | Mr. Madsen | 7,400 | | | $ | 1,572,722 | |

(1)All officer PSUs awarded on March 15, 2021. (2)The grant date unit value asfor awards made on March 15, 2021 of February 14, 2020: | | | | | | | | | | | | | NEO | | # of PSUs(1) | | | Grant Date Value(2) | | | | | | | | | | | | | | | Mr. Adamczyk | | | 37,200 | | | $ | 7,014,804 | | | | | Mr. Lewis | | | 11,500 | | | $ | 2,168,555 | | | | | Ms. Madden | | | 11,500 | | | $ | 2,168,555 | | | | | Mr. Gautam | | | 11,200 | | | $ | 2,111,984 | | | | | Mr. Waldron | | | 9,300 | | | $ | 1,753,701 | |

(1) | All officer PSUs awarded on February 14, 2020.

|

(2) | The grant date unit value for awards made on February 14, 2020, of $188.57 was determined based on the fair market value of Honeywell stock on the date of grant of $180.92 for the three internal financial metrics, and a value of $211.53 for the relative TSR metric, based on a multifactor Monte Carlo simulation conducted by an independent valuation service provider. The grant date values reflect the original award values for the grants made in February 2020. The subsequent pandemic-related adjustment to the plan financial metrics for this cycle, made in the first quarter of 2021, is considered an award modification that will result in incremental accounting value for these awards that will be reflected as 2021 compensation on the Summary Compensation Table in the next annual Proxy Statement.

|

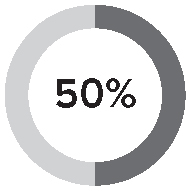

$212.53 was determined based on the fair market value of Honeywell stock on the date of grant of $214.85 for the three internal financial metrics, and a value of $205.57 for the Relative TSR metric, based on a multifactor Monte Carlo simulation conducted by an independent valuation service provider. At the end of the performance period, the total number of PSUs earned for each NEO shall be determined on a formulaic basis. Dividend equivalents applied during the vesting period as additional PSUs will be adjusted based on the final number of PSUs earned. In determining the final distributions of earned awards, 50% of the resulting PSUs earned will be converted to shares of Company common stock and issued to each NEO, subject to the holding period requirements for officers. The remaining 50% shall be converted to cash based on the fair market value of a share of Honeywell stock on the last day of the performance period and paid to each NEO in the first quarter following the end of the performance period.

I

| | | | | | | | | | 68 | | Notice and Proxy Statement | 2022 |

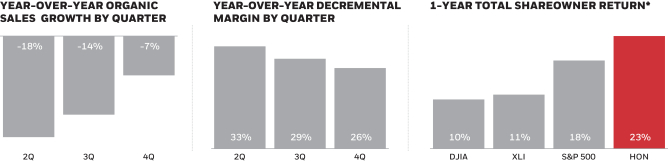

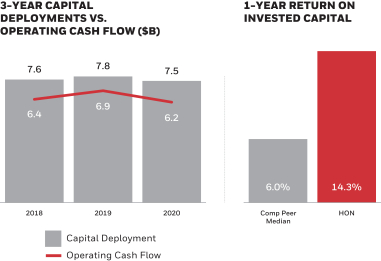

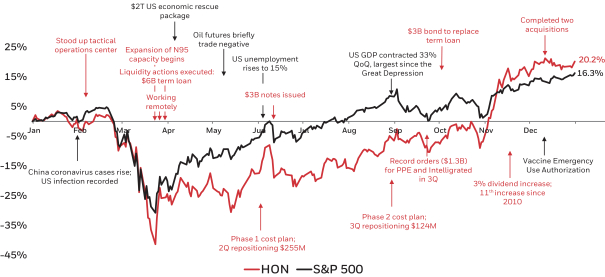

COMPENSATION DISCUSSION AND ANALYSIS 2020-2022 PERFORMANCE PLAN As fully discussed in Honeywell's 2021 Proxy Statement, on March 15, 2021, the MDCC approved an adjustment to the three financial metrics under the 2020-2022 Performance Plan due to the extraordinary impacts of the COVID-19 pandemic, which rendered the original financial targets unattainable within months of them being set in February 2020. This change was necessary to correct a misalignment between the pay opportunity and the range of performance reasonably attainable for this cycle. No changes were made to the original three-year Relative TSR goal. The recast financial targets were fully disclosed in the 2021 proxy statement. Coincident with this change, the upside total payout opportunity for this performance cycle was reduced by 40%. This action was reviewed with shareowners during 2021 outreach meetings and broadly viewed as appropriate under the circumstances, with recognition that adverse pandemic-related impacts on incentive plans were not unique to Honeywell and that thoughtful recalibrations were appropriate in industries hardest hit by the COVID-19 pandemic. In arriving at this decision in the first quarter of 2021, the MDCC took into consideration management’s response and efforts to mitigate pandemic impacts in 2020 by quickly implementing cost controls (such as no merit increases in 2020 and 10% salary reductions from March 31, 2020 through November 1, 2020.) and pivoting to new opportunities aimed at positioning the Company for post-pandemic growth and shareowner value creation, which resulted in a total shareowner return of 23% for 2020. Consideration was also given to the fact that the 2018-2020 performance cycle and 2020 ICP awards were paid out without adjustment, despite being significantly adversely impacted by the COVID-19 pandemic. The MDCC also determined that this change was in alignment with the experience of both shareowners and employees in 2020. Since the pandemic-driven low of $103.86 on March 23, 2020, Honeywell’s stock price appreciated 105% to $212.70 as of December 31, 2020. The adjustment approach used for the NEOs was also extended to the cash-based performance units issued to other executive and management-level employees of the Company in 2020. While the original grant date value of the 2020-2022 PSU awards issued in February 2020 to the NEOs was already reported as 2020 compensation on the Summary Compensation Table included in the Company's 2021 proxy statement (except for Ms. Dallara and Mr. Madsen, who were not NEOs in 2020), and no new awards were made, the aforementioned adjustment to the financial metrics is considered an award modification that gives rise to incremental reportable compensation in the year the modification was made under SEC rules. As such, the calculated incremental fair value of the 2020-2022 PSU award modification to the NEOs, determined as of March 15, 2021, is included as incremental 2021 compensation in the Stock Awards column of the Summary Compensation Table and in the Grants of Plan-Based Awards Table in this proxy statement as follows: | | | | | | | NEO | 2020-2022 Performance Stock Units Modification (1) | | Mr. Adamczyk | $4,754,160 | | | Mr. Lewis | $1,469,700 | | | Ms. Madden | $1,469,700 | | | Ms. Dallara | $1,337,108 | | | Mr. Madsen | $898,594 | |

(1)Represents the incremental fair value, determined as of the March 15, 2021 modification date, in accordance with FASB ASC Topic 718 for a Type III modification, with no offset for forfeiture of the portion of the original award that became improbable of attainment due to the impacts from the COVID-19 pandemic. The MDCC viewed this adjustment as a realignment to the intended grant date values originally reported as 2020 compensation, which differs from the reported values on the Summary Compensation Table under SEC rules.

| | | | | | | | | | | | | Notice and Proxy Statement | 2022 | | 69 |

COMPENSATION DISCUSSION AND ANALYSIS 2019-2021 PERFORMANCE PLAN ASSESSMENT | | | | | 2019-2021 SUMMARY | | •Three-year cumulative Shareowner return of 55.9% (61st percentile vs. relevant Compensation Peer Group) •Financial metric attainment impacted by COVID-19 (three-year growth goals set pre-pandemic) •MDCC approved 2019-2021 PSU payout = 87% of target (CEO and Corporate officers) | |

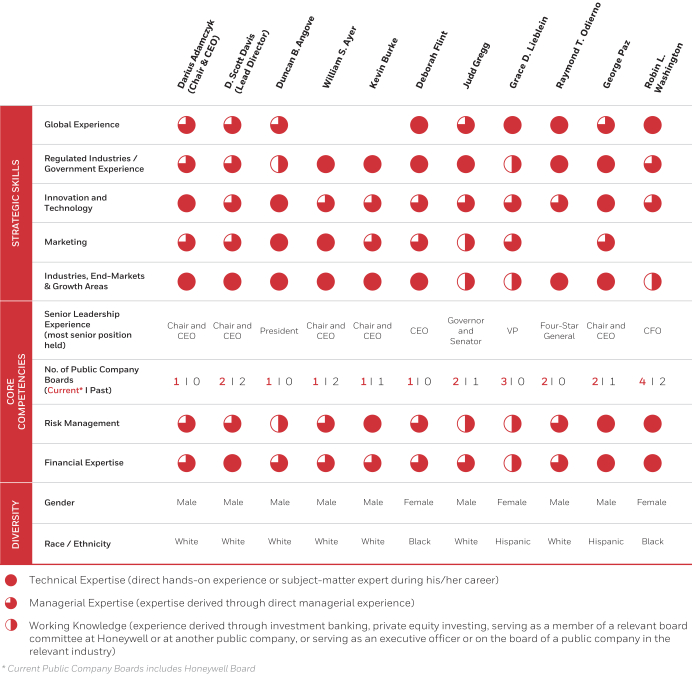

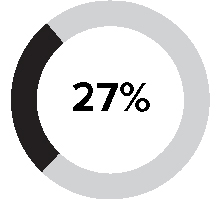

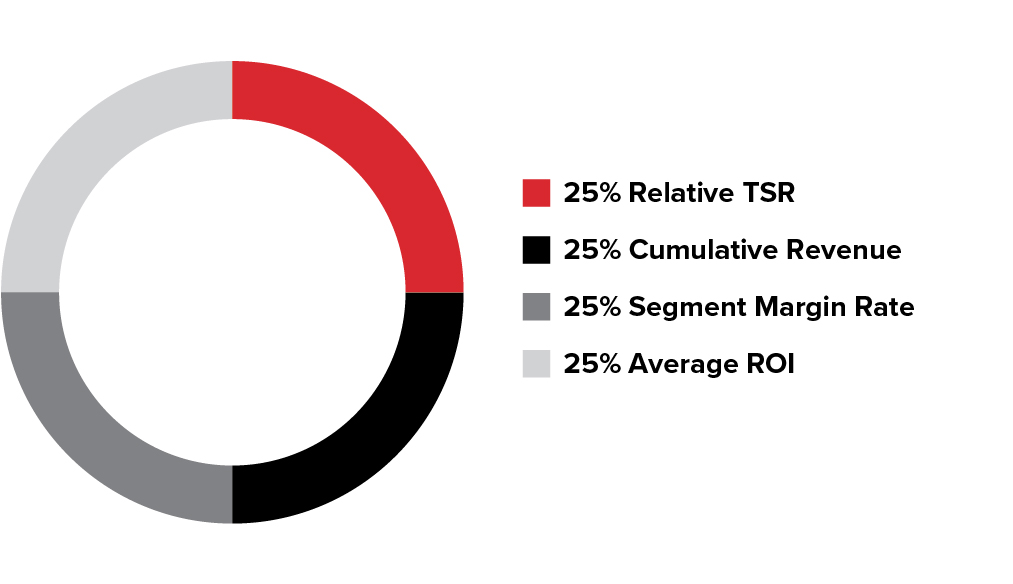

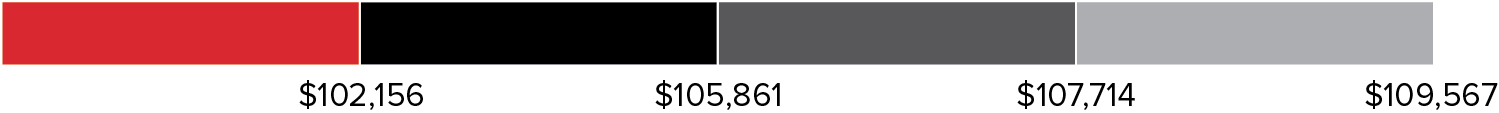

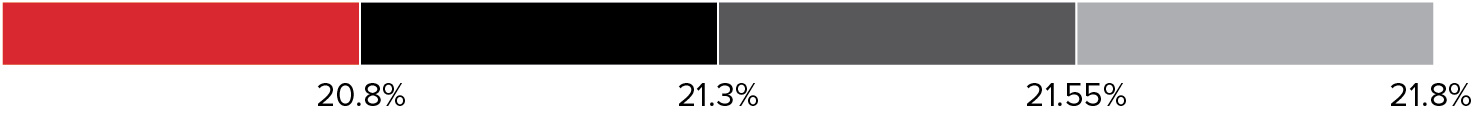

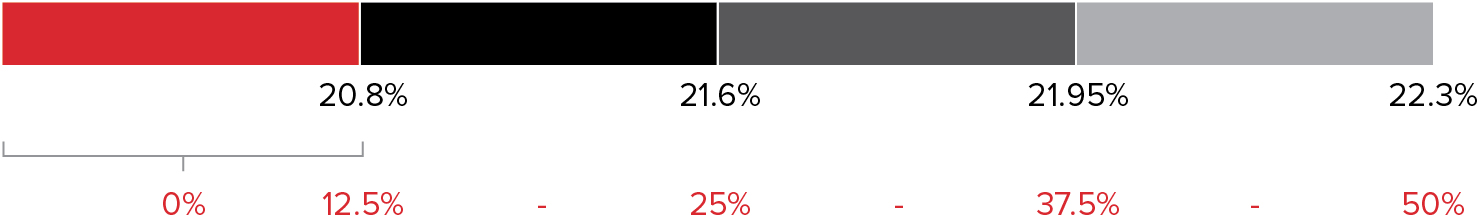

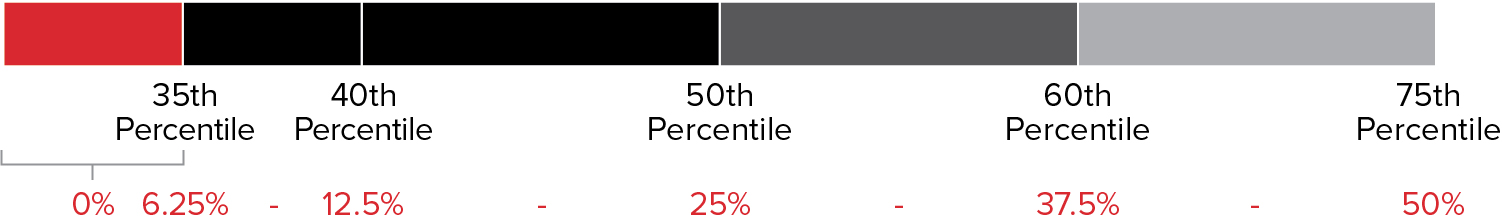

In February 2019, Performance Plan awards for a three-year performance period of January 1, 2019 through December 31, 2021 were granted to executive officers in the form of Performance Stock Units (PSUs). This applied to all NEOs except Mr. Madsen, who was not an executive officer in February 2019. Three-year performance goals were established for cumulative revenue, average segment margin rate, average return on investment (ROI) and TSR relative to the 2019 Compensation Peer Group. Each of these goals was equally weighted (25% each). The target performance levels were established before the COVID-19 pandemic as follows: 3.1% compound annual revenue growth, 80 basis points of segment margin expansion, and 140 basis points of ROI expansion. Goals were developed for each of the three years, with the first year aligned to the midpoint of external guidance, and growth rates for the second and third years in the cycle aligned with Honeywell’s long-range plan. Target performance levels were aimed at driving year-over-year growth and meaningful improvements in Honeywell operations over the three-year period. By the fourth quarter of 2020, it became clear that the 2019-2021 financial metrics were heavily and adversely impacted by the COVID-19 pandemic, especially cumulative revenue and ROI, which were all but certain to fall below threshold levels. Projections at that time suggested that it may not be possible to offset the downward drag of pandemic-related 2020 results on the three-year cumulative goals, despite strong performance in 2019. In contrast, the three-year Relative TSR metric was tracking above target, in tandem and alignment with the shareowner experience. Since the 2019-2021 PSU performance period was nearly two-thirds completed, the plan-basis Relative TSR metric was tracking above target, and there was increasing optimism regarding the post-pandemic business conditions, the MDCC took a conservative approach and continued monitoring performance through the end of the cycle before making any decision. Throughout 2021, the MDCC was provided with, and studied, updates on the 2019-2021 Performance Plan at its February, March, September, and December 2021 meetings. The MDCC conducted rigorous due diligence in considering how to address the following external and internal factors: •The impact of the extended duration of the pandemic and unprecedented global supply chain issues. •Three-year TSR performance for shareowners both on an absolute basis and relative to the Compensation Peer Group. •Heightened human capital risks brought on by intensifying competition for talent. •Incentive plan adjustments disclosed by companies within the Fortune 100. •Honeywell executive-level retention and turnover information as compared to prior years. •Holistic view of compensation actions over the three-year period and the degree of impact from the pandemic. PSU Formulaic Calculation In February 2022, the MDCC reviewed the outcomes for the 2019-2021 executive officer PSUs, determined as of December 31, 2021, calculated without taking into consideration the unusual and extraordinary impacts of the COVID-19 pandemic. The following table displays the formulaic 2019-2021 PSU calculation payout results: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total Honeywell | Threshold | Target | Maximum | | Actual Plan Performance(1) | | Payout

Factor | Weight | Weighted

Payout % | | 3-Year Cumulative Revenue ($M) | $108,543 | $112,480 | $116,417 | | $103,775 | | 0 | % | 25 | % | 0 | % | | 3-Year Average Segment Margin Rate | 20.7% | 21.2% | >= 21.7% | | 20.8 | % | | 60 | % | 25 | % | 15 | % | | 3-Year Average ROI | 23.4% | 24.2% | >= 24.9% | | 22.1 | % | | 0 | % | 25 | % | 0 | % | | 3-Year Relative TSR | 35th Percentile | 50th Percentile | >= 75th Percentile | | 61st Percentile | | 154 | % | 25 | % | 39 | % | | | | | | | | | | | | Total PSU Calculated Percentage–Corporate NEOs (Messrs. Adamczyk and Lewis, and Ms. Madden)–Based 100% on performance against Total Honeywell goals | 54 | % | | | | | | | | | | | Total PSU Calculated Percentage–HCE Business Unit (Ms. Dallara)–Financial metrics portion based 67% on Total Honeywell and 33% on Business Unit goals(2) | 71 | % | | | | | | | | | | | (1)Consistent with goal setting parameters, revenue was adjusted to exclude the impact of corporate transactions and fluctuations in foreign currency. Segment margin was adjusted to exclude the impact of corporate transactions. ROI was adjusted to exclude the impact of corporate transactions and the impact of pension income and asset fluctuations. | (2)Business Unit goals are based on the business unit’s performance on three-year revenue and segment margin performance. |

| | | | | | | | | | 70 | | Notice and Proxy Statement | 2022 |

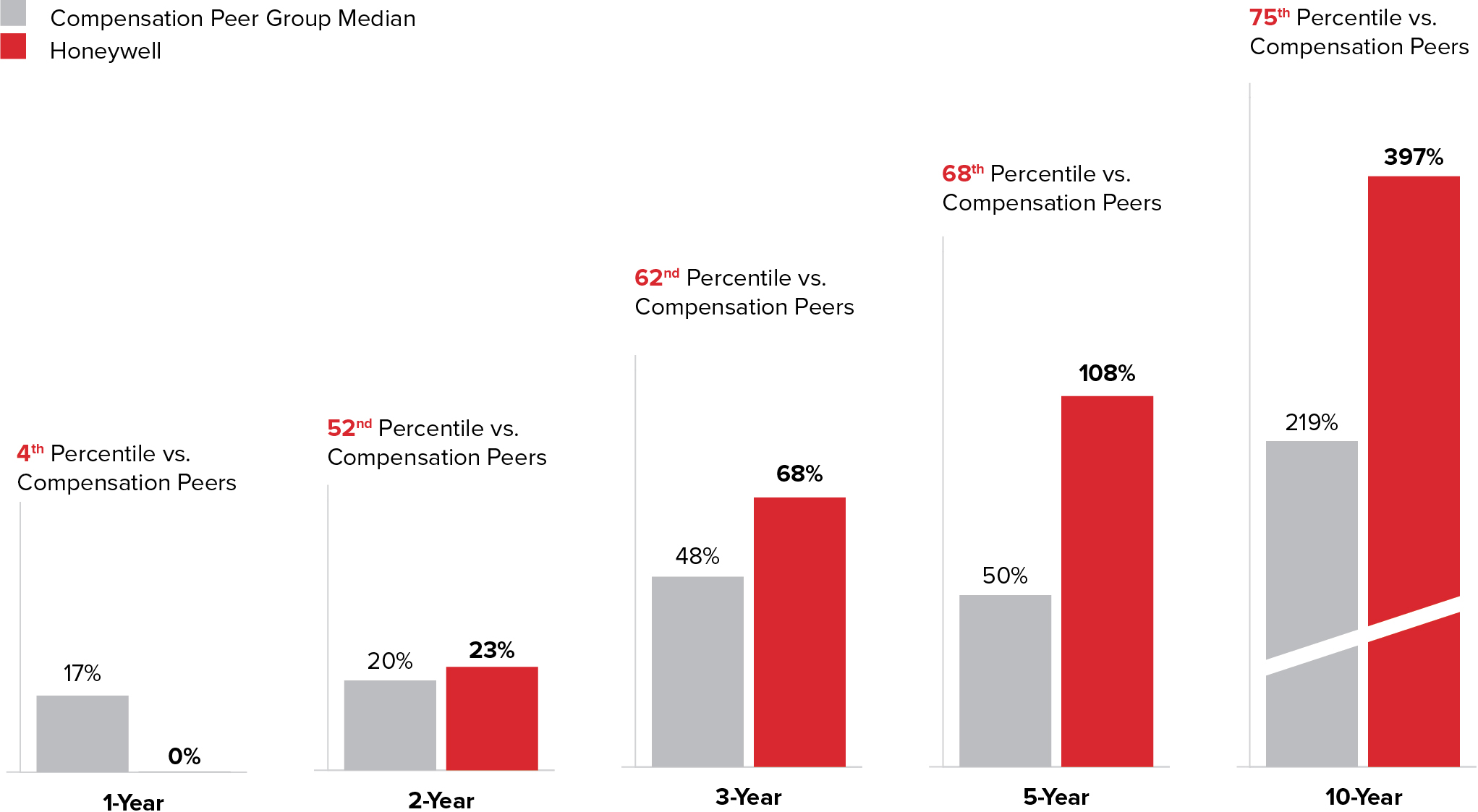

COMPENSATION DISCUSSION AND ANALYSIS Honeywell’s plan-basis TSR of 55.9% was above the median of our 2019 Compensation Peer Group for the three-year performance period of January 1, 2019 - December 31, 2021), as follows: | | | | | | | | | | Company Name | 3-Year TSR(1) | 3-Year Relative

Percentile Ranking | | Johnson Controls International plc | 157.2 | % | 100 | % | | Eaton Corporation plc | 155.0 | % | 92 | % | | Deere & Company | 130.1 | % | 85 | % | | Illinois Tool Works, Inc. | 93.8 | % | 77 | % | | Caterpillar, Inc. | 66.5 | % | 69 | % | | Emerson Electric Co. | 56.6 | % | 62 | % | | General Electric Company | 36.3 | % | 54 | % | | Raytheon Technologies Corp. | 34.0 | % | 46 | % | | Lockheed Martin Corporation | 30.5 | % | 38 | % | | General Dynamics Corporation | 29.4 | % | 31 | % | | 3M Company | (0.6) | % | 23 | % | | Phillips 66 | (12.0) | % | 15 | % | | Schlumberger Limited | (22.2) | % | 8 | % | | The Boeing Company | (43.4) | % | 0 | % | | 2019 Compensation Peer Group Median | 35.1 | % | | | Honeywell International Inc. | 55.9 | % | 61 | % |

(1) Three-year TSR on ‘plan basis’, which uses a 30-trading day average of stock prices from the beginning, and to the end, of the three-year performance period. Payout Decision In February 2022, the MDCC reviewed and assessed the overall formulaic PSU calculation for the 2019-2021 PSU cycle for the NEOs that received them. The MDCC noted that the unusual and extraordinary adverse impacts from the COVID-19 pandemic resulted in zero or low payouts on the three original financial metrics (e.g., 0% for Corporate three-year Cumulative Revenue and three-year Average ROI) that did not adequately or appropriately reflect the performance of the Company over the period and management’s performance and response to the COVID-19 pandemic. The minimal calculated payouts for the three financial metrics were also not in tandem with the shareowner experience, as Honeywell’s Relative TSR for the three-year period ranked above the median of our peer group companies, at the 61st percentile. In response, the MDCC discussed several alternatives for the 2019-2021 PSUs to better align pay with performance. Alternatives discussed included: (i) adjusting the goals or measurement against them by quantifying the impacts of the pandemic on the original targets; (ii) basing the payout purely on Relative TSR; (iii) aligning the PSU payouts with the payouts determined under the 2019-2021 performance cash units to non-officer executives for the same time period, or (iv) modifying the weighting applied in the calculation to each of the four original three-year goals. The Committee also discussed making no changes and allowing the misaligned payouts to occur. Upon fully assessing and evaluating performance and risks for the full 2019-2021 performance period, in February 2022 the MDCC exercised its authority under the plan to make an appropriate adjustment to the weighting applied to the metrics under the plan for only this 2019-2021 cycle. The original financial goals remained in the calculation to preserve the integrity of the program, but their weighting was reduced from 75% to 50%, to recognize that the pandemic impacts were not contemplated when the goals were originally established, and that the results were adversely and materially impacted by global market forces. The weight applied to the three-year Relative TSR goal was increased from 25% to 50%, to better align with the shareowner experience. The MDCC determined that the payouts based on this approach better reflected leadership performance and long-term actions taken over the measurement period, as well as the investor experience, while still resulting in a below target payout for this unprecedented and challenging performance period. The MDCC also recognized that this was the last overlapping cycle to be severely impacted by the COVID-19 pandemic, and that regular compensation program awards made in 2021, as discussed earlier in this Proxy Statement, reflect the restoration of the ‘normal state’ executive compensation program structure and design elements that shareowners have overwhelmingly supported since being fully implemented in 2018.

| | | | | | | | | | | | | Notice and Proxy Statement | 2022 | | 71 |

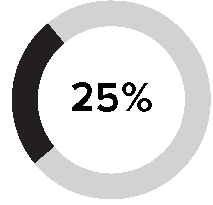

COMPENSATION DISCUSSION AND ANALYSIS The following table displays the 2019-2021 PSU calculation payout for Corporate NEOs with the adjusted weighting, as determined by the MDCC: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total Honeywell | Threshold | Target | Maximum | | Actual Plan Performance(1) | | Payout

Factor | Weight (adjusted) | Weighted

Payout % | | 3-Year Cumulative Revenue ($M) | $108,543 | $112,480 | $116,417 | | $103,775 | | 0 | % | 16.67 | % | 0 | % | | 3-Year Average Segment Margin Rate | 20.7% | 21.2% | >= 21.7% | | 20.8 | % | | 60 | % | 16.67 | % | 10 | % | | 3-Year Average ROI | 23.4% | 24.2% | >= 24.9% | | 22.1 | % | | 0 | % | 16.67 | % | 0 | % | | 3-Year Relative TSR | 35th Percentile | 50th Percentile | >= 75th Percentile | | 61st Percentile | | 154 | % | 50 | % | 77 | % | | | | | | | | | | | | Total PSU Calculated Percentage–Corporate NEOs (Messrs. Adamczyk and Lewis, and Ms. Madden)–Based 100% on performance against Total Honeywell goals | 87 | % | | | | | | | | | | | | Total PSU Calculated Percentage–HCE Business Unit (Ms. Dallara)–Financial metrics portion based 67% on Total Honeywell and 33% on Business Unit goals | 99 | % | | | | | | | | | | | (1)Consistent with goal setting parameters, revenue was adjusted to exclude the impact of corporate transactions and fluctuations in foreign currency. Segment margin was adjusted to exclude the impact of corporate transactions. ROI was adjusted to exclude the impact of corporate transactions and the impact of pension income and asset fluctuations. |

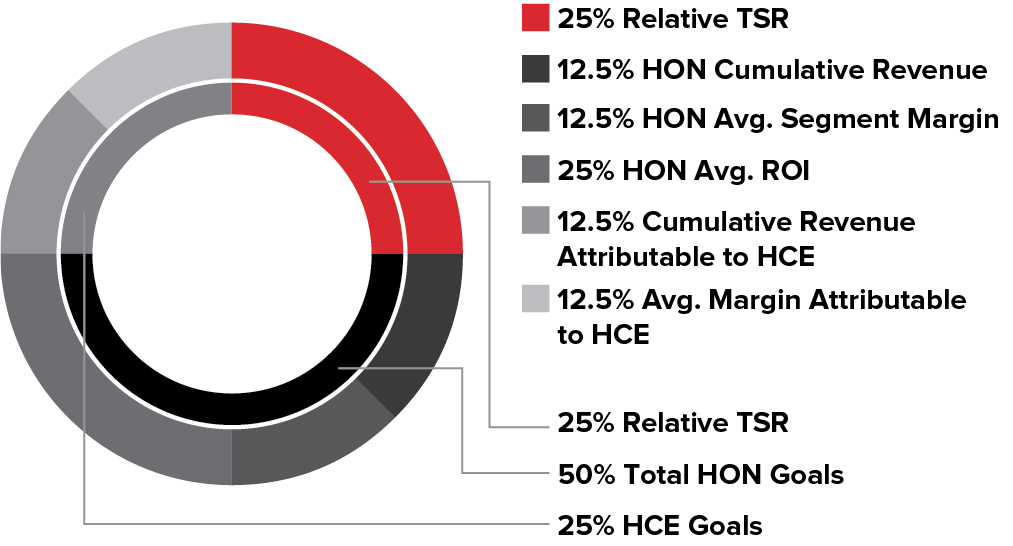

The payout percentage for HCE (Ms. Dallara) differed from the Corporate NEOs as the financial metrics portion of her award was based on performance against both Total Honeywell metrics and metrics established for the HCE business unit. Detailed metrics for the HCE business unit are not disclosed because we have determined that such information involves confidential commercial and financial information, the disclosure of which would result in competitive harm for Honeywell. 2019-2021 PSU Payouts (Messrs. Adamczyk and Lewis and Mses. Madden and Dallara) Based on the final approved award payout percentages for the 2019-2021 performance period for those NEOs who received their 2019-2021 Performance Plan award in the form of PSUs, the MDCC approved the following individual awards to the NEOs: | | | | | | | | | | | | | NEO | 2019-2021 PSUs at Target (1) | Total Payout % | Total 2019-2021 PSUs Earned | | Mr. Adamczyk | 43,640 | 87 | % | 37,967 | | | Mr. Lewis | 11,595 | 87 | % | 10,088 | | | Ms. Madden | 11,595 | 87 | % | 10,088 | | | Ms. Dallara | 8,855 | 99 | % | 8,766 | |

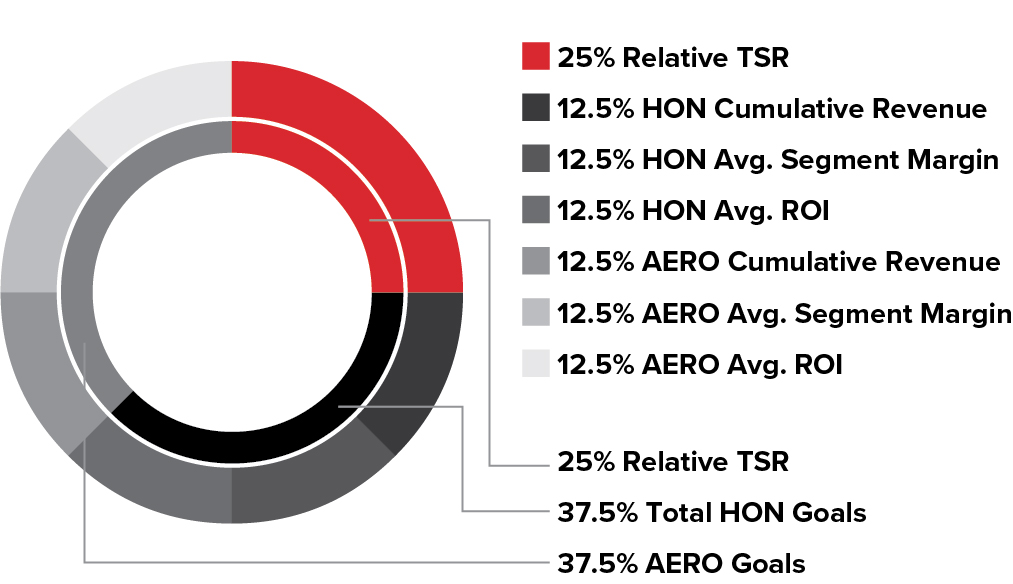

(1)Includes additional PSUs from dividend equivalents. Earned awards became fully vested on February 26, 2022. 50% of the PSUs earned were converted to shares of Honeywell common stock, with the net shares paid subject to an additional one-year holding period, in accordance with the officer stock ownership guidelines. The remaining 50% was converted to cash based on the closing stock price of Honeywell common stock on December 31, 2021 and paid in March 2022. 2019-2021 Performance Cash Unit Payouts (Mr. Madsen only) In February 2022, the MDCC also reviewed the calculated outcomes for the 2019-2021 Performance Plan Cash Units (PCUs) issued to 490 non-officer executives in 2019 (which included Mr. Madsen, who was a non-officer at the time of grant). The following summarizes the structure of the 2019-2021 PCU awards, which was different from the officer PSUs described above: | | | | | | | Eligible Participants | •Non-Officers (Executives) | | Form of Award | •PCUs denominated at $100 per unit and settled in cash | | Mix of Goals | •Equally weighted between Total Honeywell and Business Unit goals (50% Total Honeywell and 50% Aerospace) | | Measurement and Goal Weighting | •Measurement for three, single years, 2019, 2020 and 2021*, with the total payout factor equal to the average of the three years. Cash payout is delayed to the end of the 3 years. For each year, 100% weight on financial metrics with 33.3% weight on each of three Corporate goals: –1-Year Cumulative Revenue (for each of 2019, 2020, and 2021) –1-Year Average Segment Margin Rate (for each of 2019, 2020, and 2021) –1-Year Average ROI (for each of 2019, 2020, and 2021) | | Payout Cap | •120% of target | | Stock Performance Goal | •Not applicable |

*The MDCC set the annual target for the 2021 annual measurement period in March 2021 based on 2021 financial guidance and annual operating plan targets established in the first quarter of 2021. Previously established annual goals for 2019 or 2020 remained unchanged, despite 2020 also being significantly impacted by the pandemic. | | | | | | | | | | 72 | | Notice and Proxy Statement | 2022 |

COMPENSATION DISCUSSION AND ANALYSIS The following table displays the results of the 2019-2021 Performance Plan calculation for all Aerospace business unit executives (non-officer) who received PCUs in 2019 (including Mr. Madsen): | | | | | | | | | | | | | | | | | | | | | | | | | | | AERO Performance Goals (1) | 2019 Performance | 2020 Performance (Pandemic Impacted) | 2021 Performance | | 3-Year Average Performance(2) | | Weight | Weighted Payout % | | Revenue | 163 | % | 0 | % | 82% | | 81.7 | % | | 33.33 | % | 27 | % | | Segment Margin Rate | 180 | % | 100 | % | 160% | | 146.7 | % | | 33.33 | % | 49 | % | | ROI | 163 | % | 0 | % | 50% | | 71.0 | % | | 33.33 | % | 24 | % | | | | | | | | | | | Total Earned Cash Unit Payout Percentage – AERO executives (non-officer), includes Mr. Madsen as non-officer in 2019 | 100 | % |

(1)Results for AERO executives based 50% on performance against Total Honeywell targets and 50% on performance against Aerospace targets. (2)Consistent with goal setting parameters, revenue was adjusted to exclude the impact of corporate transactions and fluctuations in foreign currency. Segment margin was adjusted to exclude the impact of corporate transactions. ROI was adjusted to exclude the impact of corporate transactions and the impact of pension income and asset fluctuations. Based on the final approved award payout percentage for non-officer Aerospace executives who received a 2019-2021 Performance Plan award in the form of performance cash units, the following individual award was earned by Mr. Madsen: | | | | | | | | | | | | | | | | NEO | 2019-2021 Performance Cash Units at Target | Value Per

Unit | Total Earned

Award % | Total 2019-2021 Performance Cash Award Earned | | Mr. Madsen | 5,110 | $100 | 100 | % | $511,000 |

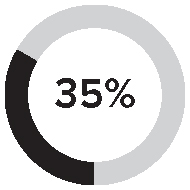

The earned award for Mr. Madsen became fully vested on February 26, 2022 and was paid in cash in March 2022. In accordance with SEC disclosure requirements for cash-based awards, 100% of the earned cash award for Mr. Madsen for the 2019-2021 performance period is included as 2021 Non-Equity Incentive Compensation on the Summary Compensation Table, even though originally granted in 2019. The MDCC considered this 2019-2021 cash unit award as part of Mr. Madsen's 2019 total annual direct compensation (in the year it was granted), which differs from how it is reported on the Summary Compensation Table. Mr. Madsen became an Executive Officer in October 2019, and he has received PSU awards since then. Stock options granted to the NEOs in February 20202021 represented 35% of their total annual LTI value and mix. The MDCC believes that stock options continue to be an important element for focusing executives on actions that drive long-term stock appreciation that is directly aligned with the interests of our shareowners. Stock options granted to Mr. Adamczyk and all the otherOther NEOs vest 25% per year over four years and have a 10-year term to exercise. The strike price for the 20202021 annual stock options is $180.92,$202.72, which was the fair market value of Honeywell stock on the date of grant (February 14, 2020)12, 2021). The grant date value was determined using a Black-Scholesfair value of $21.41 per share asa stock option was determined by a third-party valuation company.company using a Black-Scholes valuation method. The following table presents the number of stock options granted to the NEOs along with their respective grant date values. | | | | | | | | | | | | | NEO | | # of Stock Options Awarded (1) | | | Grant Date Value (2) | | | | | | | | | | | | | | | Mr. Adamczyk | | | 228,800 | | | $ | 4,898,608 | | | | | Mr. Lewis | | | 70,200 | | | $ | 1,502,982 | | | | | Ms. Madden | | | 70,200 | | | $ | 1,502,982 | | | | | Mr. Gautam | | | 68,600 | | | $ | 1,468,726 | | | | | Mr. Waldron | | | 57,200 | | | $ | 1,224,652 | |

| | | | | | | | | | | | | NEO | # of Stock Options (1) | Grant Date Value (2) | | Mr. Adamczyk | 163,500 | | $ | 5,248,350 | | | Mr. Lewis | 51,200 | | $ | 1,643,520 | | | Ms. Madden | 51,200 | | $ | 1,643,520 | | | Ms. Dallara | 42,500 | | $ | 1,364,250 | | | Mr. Madsen | 34,100 | | $ | 1,094,610 | |

(1)All officer stock options awarded on February 12, 2021. Options vest 25% per year over four years from the grant date. Upon exercise, stock options are settled in shares of Honeywell stock with the NEO required to hold the resulting net gain shares at least one year before being able to sell them. (2)The grant date value was determined using a Black-Scholes value of $32.10 per option. (1) | All officer stock options awarded on February 14, 2020. Options vest 25% per year over four years from the grant date.

|

(2) | The grant date value was determined using a Black-Scholes value of $21.41 per share.

|

| | | | | | | | |

| | |Notice and Proxy Statement | 2021 2022

| | 64

73 |

COMPENSATION DISCUSSION AND ANALYSIS

| | | 06 | | | COMPENSATION DISCUSSION

AND ANALYSIS

|

IRESTRICTED STOCK UNITS

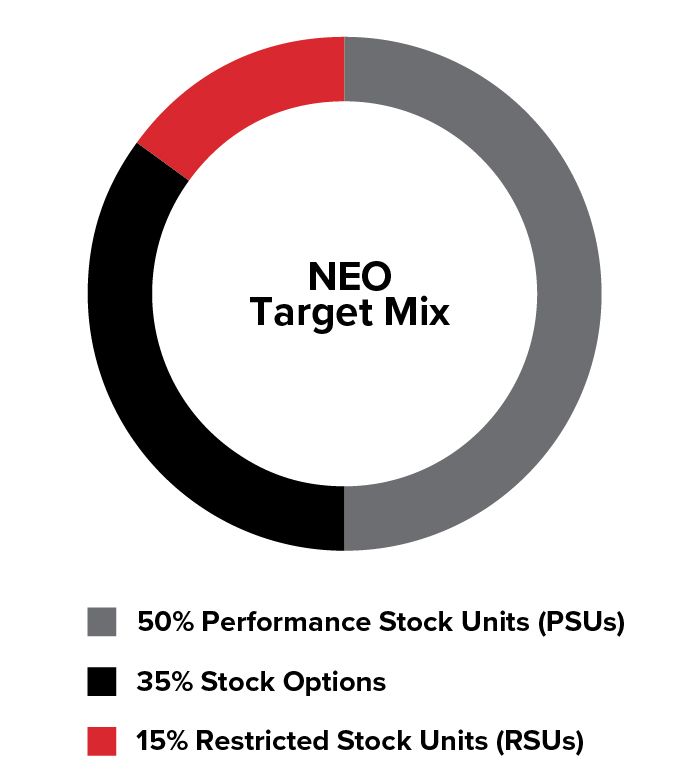

RSUs granted to the NEOs in February 20202021 represented 15% of their total annual LTI value and mix. RSUs granted to Mr. Adamczyk, and all the otherOther NEOs, vest 33%, 33%, 34% on the second, fourth, and sixth anniversaries of the grant date, respectively. This extended vesting period is designed to strengthen retention. The following table presents the number of RSUs granted to the NEOs in 20202021 along with their respective grant date values. | | | | | | | | | | | | | NEO | | Target # of RSUs (1)(2) | | | Grant Date Value (3) | | | | | | | | | | | | | | | Mr. Adamczyk | | | 11,600 | | | $ | 2,098,672 | | | | | Mr. Lewis | | | 3,500 | | | $ | 633,220 | | | | | Ms. Madden | | | 3,500 | | | $ | 633,220 | | | | | Mr. Gautam | | | 3,400 | | | $ | 615,128 | | | | | Mr. Waldron | | | 2,900 | | | $ | 524,668 | |

(1) | All officer RSUs awarded on February 14, 2020.

|

(2) | Officer RSUs vest 33%, 33%, 34% on the second, fourth, and sixth anniversaries of the grant date, respectively. During the vesting period, dividend equivalents will be earned in the form of additional RSU shares based on regular dividends paid by Honeywell, with such additional dividends vesting on the same timing as the underlying RSUs to which they relate. In addition, upon vesting, the NEO must hold the resulting net gain shares for at least one year before being eligible to sell the shares.

|

(3) | Based on a grant date value $180.92 determined using the average of the high and low stock prices of Honeywell stock on the grant date.

|

| | | | | | | | | | | | | NEO | # of RSUs (1)(2) | Grant Date Value (3) | | Mr. Adamczyk | 11,000 | | | $ | 2,229,920 | | | Mr. Lewis | 3,400 | | | $ | 689,248 | | | Ms. Madden | 3,400 | | | $ | 689,248 | | | Ms. Dallara | 2,800 | | | $ | 567,616 | | | Mr. Madsen | 2,300 | | | $ | 466,256 | |

(1)All officer RSUs awarded on February 12, 2021. (2)Officer RSUs vest 33%, 33%, 34% on the second, fourth, and sixth anniversaries of the grant date, respectively. During the vesting period, dividend equivalents will be earned in the form of additional RSU shares based on regular dividends paid by Honeywell, with such additional dividends vesting on the same timing as the underlying RSUs to which they relate. In addition, upon vesting, RSUs are settled in shares of Honeywell stock with the NEO required to hold the resulting net shares at least one year before being able to sell them. (3)Based on a grant date value of $202.72, determined using the average of the high and low stock prices of Honeywell stock on the grant date. OTHER COMPENSATION AND BENEFIT PROGRAMS I

We offer various retirement benefits to our NEOs. Specifically, depending upon when and where they joined the Company, some NEOs may participate in broad-based plans, including a defined benefit pension plan and a 401(k) savings plan that provides matching Company contributions. We also maintain an unfunded supplemental retirement plan to replace the portion of an executive’s pension benefit that cannot be paid under the broad-based plans because of Internal Revenue Service (IRS) limitations. More information on retirement benefits can be found beginning on page 76.I84.

NONQUALIFIED DEFERRED COMPENSATION PLANS Executive officers

Honeywell executives (including the NEOs) may choose to participate in certain nonqualified deferred compensation plans to permit retirement savings in a tax-efficient manner. Executive officersExecutives can elect to defer up to 100% of their annual ICP awards. In addition, executive officersexecutives may also participate in the Honeywell Supplemental Savings Plan to defer base salary that cannot be contributed to the Company’s 401(k) savings plan due to IRS limitations. These amounts are matched by the Company only to the extent required to make up for a shortfall in the available match under the 401(k) savings plan due to IRS limitations. Deferred compensation balances earn interest at a fixed rate based on the Company’s 15-year cost of borrowing, which is subject to change on an annual basis. Consistent with the long-term focus of the executive compensation program, matchingbasis (1.74% for 2021). Matching contributions are treated as if invested in Company common stock. These plans are explained in more detail beginning on page 78.I87.

Our NEOs are entitled to participate in Honeywell-wide benefits such as life, medical, dental, and accidental death and disability insurance that are competitive with other similarly sized companies. The NEOs participate in these programs on the same basis as the rest of our salaried employees. We also maintain low-cost excess liability coverage for all executive-level personnel, including the NEOs. The NEOs are also eligible for an annual executive physical, and Charlotte-based officers participate in a low-cost regional concierge medical service program which was first introduced in 2020.program. Our security policy requires that our Chairman and CEO use Honeywell aircraft for all air travel (business or personal) to ensure personal security and protect the confidentiality of our business. From time to time, we also permit other executive officers to use Honeywell aircraft for personal or business use. The security plan for the Chairman and CEO also provides for home security and related monitoring. | | | | | | | | | 65

74 | |

| | | |Notice and Proxy Statement | 2021

| | | 2022 |

COMPENSATION DISCUSSION AND ANALYSIS

| | | 06 | | | COMPENSATION DISCUSSION

AND ANALYSIS

|

COMPENSATION PRACTICES AND POLICIES

| | | | | | | | | | | | | | | | | | | | | I WHAT WE DO | | | | I WHAT WE DON’T DO | | | | | | | | | | | | | | |

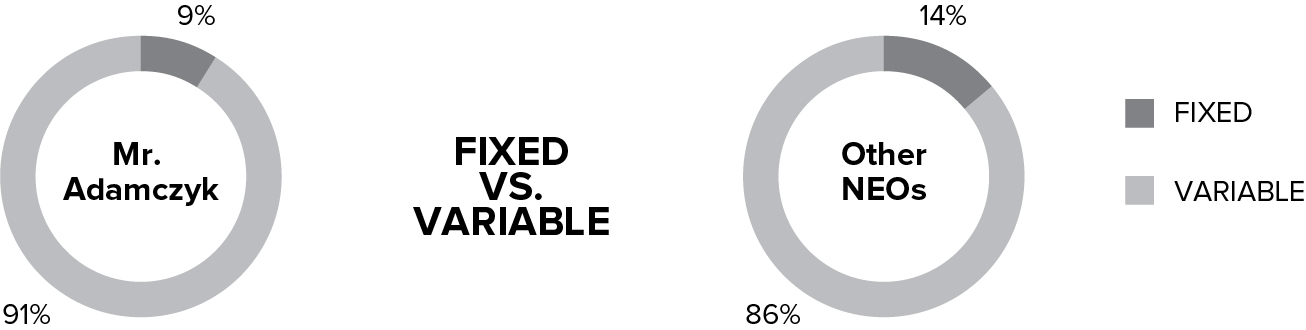

| | Pay for Performance. We closely align pay and performance, with a significant portion of target total direct compensation at-risk. The MDCC validates this alignment annually and ensures performance-based compensation represents a significant portion of executive compensation.

| | | |

| | No Excessive Perks. We do not provide perquisites except in cases where there is a compelling business or security reason, nor do we provide tax gross-ups for officers, other than in connection with a Company-required relocation. | | | | | | | | | | | | | | |

| | Robust Performance Goals. We establish clear and measurable goals and targets and hold our executives accountable for achieving specified levels to earn a payout under our incentive plans. We use different sets of operational metrics for ICP and performance-based LTI to drive top and bottom-line growth over multiple time frames, aligned with our goal of sustained long-term performance.

| | | |

| | No Guaranteed Annual Salary Increases or Bonuses. Annual salary increases are based on evaluations of individual performance and the competitive market. In addition, we do not provide guarantees on bonus payouts. | | | | | | | | | | | | | | |

| | Clawback Practices. We maintain a policy that allows for recoupment of incentive compensation for a significant financial restatement or if an executive leaves the Company to join a competitor.

| | | |

| | No Hedging or Pledging. We do not allow hedging or pledging of our stock. | | | | | | | | | | | | | | |

| | Double Trigger in the Event of a Change-in-Control (CIC). We have double trigger vesting on equity and severance for CIC; executives will not receive cash severance nor will equity vest in the event of a CIC unless accompanied by qualifying termination of employment. | | | |

| | No Excise Tax Gross-Ups and No Accelerated Bonus Payments Upon CIC. Excise tax gross-ups have been eliminated for all executive officers. Plans provide that ICP awards earned in the year of a CIC would be paid at the time they would typically be paid based on business performance rather than target.

| | | | | | | | | | | | | | |

| | Maximum Payout Caps for Incentive Plans. Annual cash incentive plan (ICP) and Performance Plan payouts are capped. | | | |

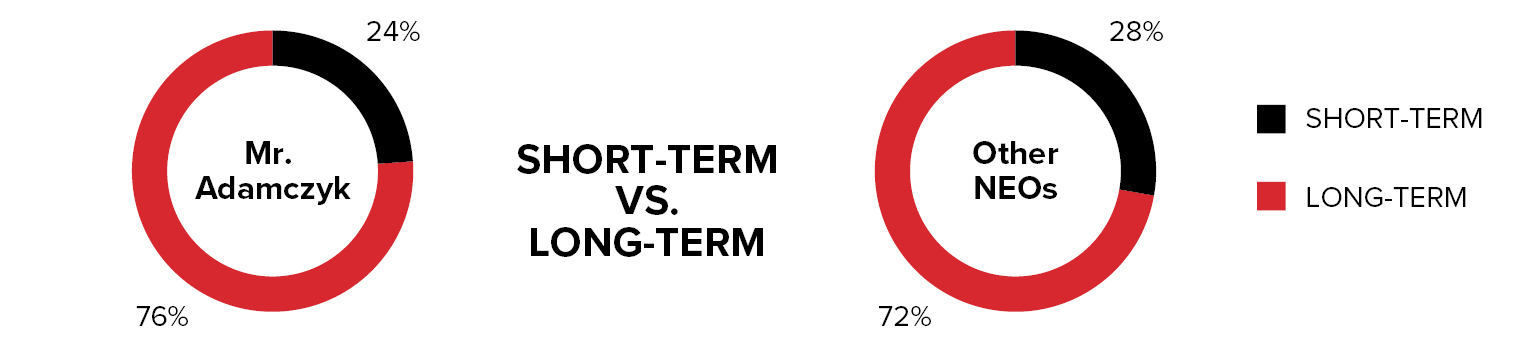

| | No Incentivizing of Short-Term Results to the Detriment of Long-Term Goals and Results. Pay mix is heavily weighted toward long-term incentives aligned with the interests of shareowners.

| | | | | | | | | | | | | | |

| | Robust Stock Ownership Requirements. We require executive officers to hold meaningful amounts of stock and require them to hold net shares for one year from exercise or vesting.

| | | |

| | No Excessive Risks. Compensation practices are appropriately structured and avoid incentivizing employees to engage in excessive risk-taking. | | | | | | | | | | | | | | |

| | Options Granted at FMV. Annual stock options awarded to all executives (including the NEOs) are approved by the MDCC on the same day, with an exercise price no less than the fair market value of Honeywell’s common stock on the date of grant.

| | | |

| | No Options Repricing. We prohibit repricing (reduction in exercise price or exchange for cash or other consideration) or reloading of stock options. | | | | | | | | | | | | | | |

| | Independent Compensation Consultant. The MDCC retains an independent compensation consultant to review and advise the MDCC on executive compensation matters. The independent consultant attends all MDCC meetings.

| | | |

| | No Consultant Conflicts. Under the MDCC’s established policy, the compensation consultant cannot provide any other services to Honeywell without the MDCC’s approval. Regular independence reviews are conducted. | | | | | | | | | |

| | | | |

| | | Notice and Proxy Statement | 2021

| | 66

|

| | | 06 | | | COMPENSATION DISCUSSION

AND ANALYSIS

|

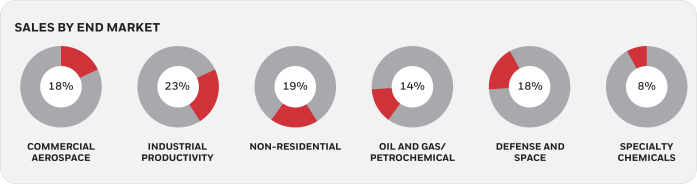

RISK OVERSIGHT CONSIDERATIONS The MDCC believes that balancing the various elements of Honeywell’s executive compensation program: •Supports the achievement of competitive sales, earnings, and cash performance in variable economic and industry conditions without undue risk; and •Mitigates the potential to reward risk-taking that may produce short-term results that appear in isolation to be favorable, but that may undermine the successful execution of the Company’s long-term business strategy and adversely impact shareowner value. The following compensation design features guard against unnecessary or excessive risk-taking: Robust processes for developing strategic and annual operating plans, approval of capital investments, internal controls over financial reporting, and other financial, operational, and compliance policies and practices.

Diversity of the Company’s overall portfolio of businesses with respect to industries and markets served (types, long-cycle / short-cycle), products and services sold, and geographic footprint.

MDCC review and approval of corporate, business, and individual executive officer objectives to ensure that these goals are aligned with the Company’s annual operating and strategic plans, achieve the proper risk/reward balance, and do not encourage unnecessary or excessive risk-taking.

| | | Robust processesfor developing strategic and annual operating plans, approval of capital investments, internal controls over financial reporting, and other financial, operational, and compliance policies and practices. | Diversity of the Company’s overall portfolioof businesses with respect to industries and markets served (types, long-cycle/short-cycle), products and services sold, and geographic footprint. | MDCC review and approvalof corporate, business, and individual executive officer objectives to ensure that these goals are aligned with the Company’s annual operating and strategic plans, achieve the proper risk/reward balance, and do not encourage unnecessary or excessive risk-taking. |

Executive Compensationcompensation features that guard against unnecessary or excessive risk-taking include: •Pay mix between fixed and variable, annual and long-term, and cash and equity compensation is designed to encourage strategies and actions that are in the Company’s long-term best interests; interests•Base salaries are positioned to be consistent with executives’ responsibilities, so they are not motivated to take excessive risks to achieve financial security; security.•Incentive awards are determined based on a review of a variety of performance indicators, diversifying the risk associated with any single performance indicator; indicator.•Design of long-term compensation program rewards executives for driving sustainable, profitable growth for shareowners; shareowners.•Vesting periods for equity compensation awards encourage executives to focus on sustained stock price appreciation; and appreciation.•Incentive plans are not overly leveraged, have maximum payout caps, and have design features that are intended to balance pay for performance with an appropriate level of risk-taking. •The MDCC also has someretains discretionary authority (e.g., 20% of awards) to adjust the annual ICP payments, which further reduces the potential for negative business risk associated with such plans. Adoption of clawback policies, which provide for the recoupment of incentive compensation paid to senior executives if there is a significant restatement of Company financial results. Clawback provisions in the Company’s current stock plan also allow the Company to cancel sharesexclude unusual or recover gains realized by an executive if non-competition or non-solicitation provisions are violated.

Prohibition on hedging and pledging of shares by executive officers and directors.

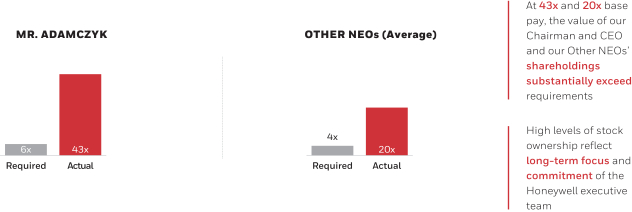

Ownership thresholds in the Company’s stock ownership guidelines for officers that require NEOs to hold shares of common stock equal to four times their current annual base salary (six times for the CEO), as detailed in the Stock Ownership Guidelines.

Officers must also hold 100% of the net shares from vesting of RSUs, the net shares issued from PSUs,infrequently occurring items, extraordinary items, and the net gain shares from option exercises for at least one year.

cumulative effect of changes in accounting treatment when determining performance attainment under formulaic plans where events and/or business conditions warrant. | | | Clawback policieswhich provide the ability to recoup performance-based incentive awards (both equity and cash-based awards) in the event of misconduct and a restatement of Company financial results. In addition, clawback provisions in the Company’s stock plan and short-term incentive plan allow the Company to cancel shares or recover gains, or payments made, if an executive violates non-competition or non-solicitation provisions. | Prohibition on hedging and pledging of sharesby executive officers and directors. | Ownership thresholdsin the Company’s stock ownership guidelines for officers that require NEOs to hold shares of common stock equal to four times their current annual base salary (six times for the CEO), as detailed in the Stock Ownership Guidelines. | Holding periods in the Company's stock ownership guidelinesrequire that officers must hold 100% of the net shares from vesting of RSUs, the net shares issued from PSUs, and the net gain shares from option exercises for at least one year. |

Based upon the MDCC’s risk oversight and compensation policies, the risks arising from the Company’s compensation policies and practices are not reasonably likely to have a material adverse effect on Honeywell’s operations or results. A full discussion of the role of the Board in the risk oversight process begins on page 2337 of this Proxy Statement. | | | | | | | | | 67

| |

| | | | Notice and Proxy Statement | 2021

| | | |

| | | 06 | | | COMPENSATION DISCUSSION

AND ANALYSIS

|

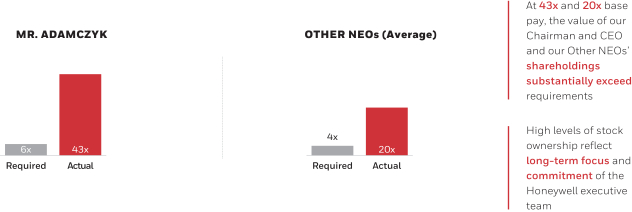

ISTOCK OWNERSHIP GUIDELINES

The MDCC believes that Honeywell executives more effectively pursue shareowners’ long-term interests if they hold substantial amounts of stock. Accordingly, the MDCC maintains minimum stock ownership guidelines for all executive officers. Under these guidelines, the Chairman and CEO must hold shares of common stock equal in value to six times his current annual base salary. Other executive officers are required to own shares equal in value to four times their current base salary. Shares used in determining whether these guidelines are met include shares held personally, equivalent shares held in qualified and nonqualified retirement accounts, outstanding RSUs, and 50% of outstanding PSUs. All NEOs maintain ownership levels well above these minimum requirements, as shown in the following table. Named Executive Officers’ Stock Ownership

| | | | | | | | | | | | | Notice and Proxy Statement | 2022 | | 75 |

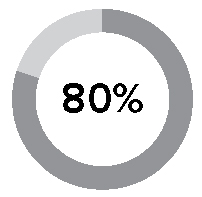

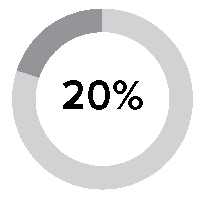

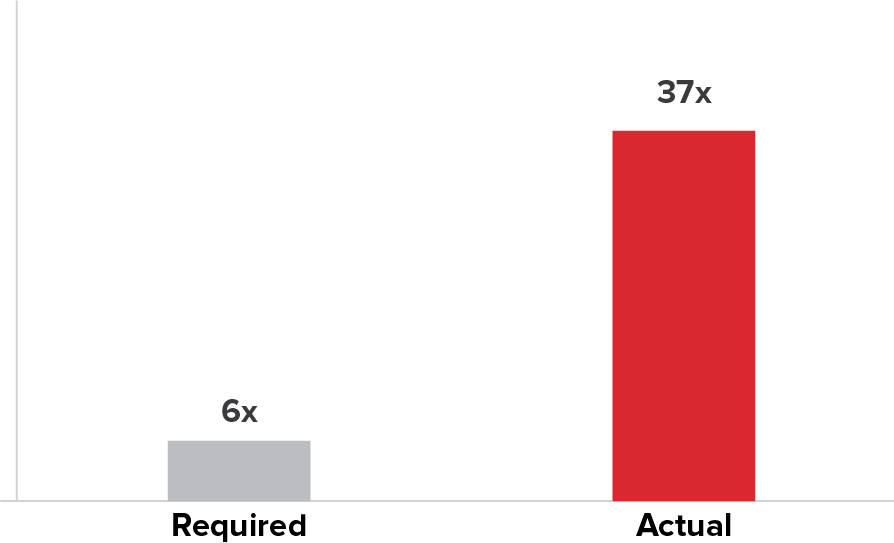

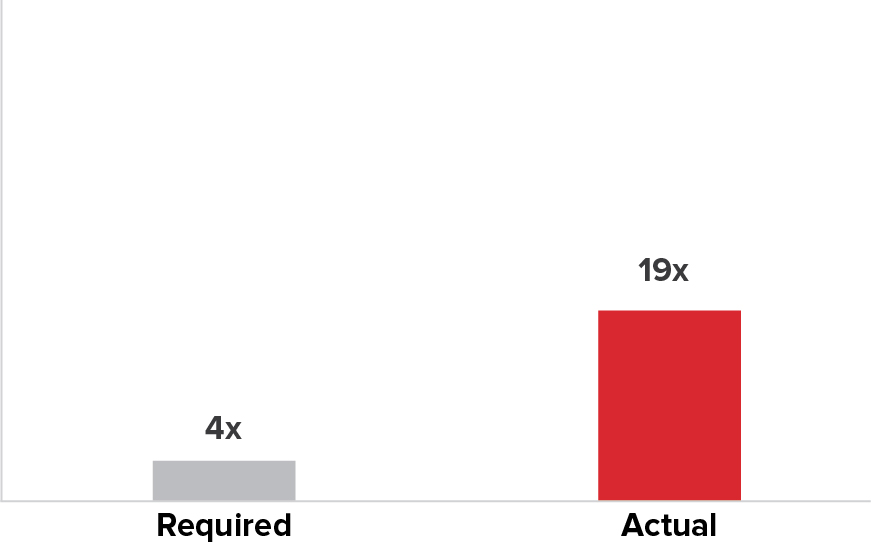

COMPENSATION DISCUSSION AND ANALYSIS NAMED EXECUTIVE OFFICERS’ STOCK OWNERSHIP | | | | | | | | | | | | | Mr. Adamczyk | | | Other NEOs (Average) | | | | | | | | | | | | | | | | | At37xand 19xbase pay, the value of our Chairman and CEO and our Other NEOs’ shareholdings substantially exceed requirements | | | High levels of stock ownership reflectlong-term focus and commitmentof the Honeywell executive team |

Represents stock ownership as of MarchFebruary 15, 2021.2022. In addition, the stock ownership guidelines require officers to hold for at least one year 100% of the “net shares” obtained from RSUs that vest, the “net shares” issued from PSUs, and the “net gain shares” obtained from the exercise of stock options. “Net shares” means the number of shares issued when RSUs vest or PSUs are earned, less the number of shares withheld or sold to pay applicable taxes. “Net gain shares” means the number of shares obtained from exercising stock options, less the number of shares needed to cover the option exercise price and applicable taxes. After the one-year holding period, officers may sell net shares or net gain shares; however, after the sale, they must continue to meet the prescribed minimum stock ownership guideline level. I

Our Corporate Governance Guidelines provide for the recoupment (or clawback) of incentive compensation paid to senior executives if there is a significant restatement of financial results (a Restatement). Under the guidelines, the Board can seek recoupment if and to the extent that: •The amount of incentive compensation was calculated based upon the achievement of financial results that were subsequently reduced due to a Restatement; •The senior executive engaged in misconduct; and •The amount of incentive compensation that would have been awarded to the senior executive had the financial results been properly reported would have been lower than the amount actually awarded. The complete text of the Corporate Governance Guidelines is posted on our website at investor.honeywell.com (see “Corporate Governance/“Governance/Governance Guidelines”Overview”). In addition, if during the two-year period following an executive officer’s termination of employment with Honeywell, he or she commences employment with, or otherwise provides services to a Honeywell competitor, without the MDCC’s prior approval, or violates non-solicitation commitments, then the Company reserves the right, for awards issued under its Stock Incentive Plans, to: •Cancel all unexercised options; and •Recover any gains attributable to options that were exercised, and any value attributable to RSUs and Performance Plan awards that were paid, during the period beginning 12 months before and ending two years after the executive officer’s termination of employment. | | | | |

| | | Notice and Proxy Statement | 2021

| | 68

|

| | | 06 | | | COMPENSATION DISCUSSION

AND ANALYSIS

|

Honeywell has entered into non-competition agreements with each of the NEOs that preclude them from going to work for a competitor for up to two years after termination of employment. The list of competitors and the duration of the non-competition covenant has been tailored, in each case, to the executive officer’s position and the competitive threat this represents. Because money damages cannot adequately compensate Honeywell for violations of these non-competition covenants, we have a full range of equitable remedies at our disposal to enforce these agreements, including the ability to seek injunctive relief. I

| | | | | | | | | | 76 | | Notice and Proxy Statement | 2022 |

COMPENSATION DISCUSSION AND ANALYSIS TAX DEDUCTIBILITY OF EXECUTIVE COMPENSATION Beginning in 2018, Section 162(m) of the Internal Revenue Code limits the federal income tax deduction for annual individual compensation to $1 million for the NEOs,Company’s “covered employees” without any exception for performance-based compensation, subject to a transition rule for certain written binding contracts in effect on November 2, 2017, and not materially modified after that date. The Company intends to comply with the transition rule for written binding contracts in effect on November 2, 2017, to the extent applicable, so long as the MDCC determines that to be in the Company’s best interest. As discussed above under Compensation Practices and Policies, the MDCC seeks to closely align executive pay with performance, even if there is no longer a “performance-based” provision under Section 162(m) , and, in any case, the MDCC reserves the ability to structure compensation arrangements to provide appropriate compensation to the Company’s executives, even where such compensation is not deductible under Section 162(m). I

PLEDGING AND HEDGING TRANSACTIONS IN COMPANY SECURITIES Executive officers, directors, and any of their respective designees are prohibited from pledging Honeywell’s securities or using Honeywell’s securities to support margin debt. All other employees must exercise extreme caution in pledging Honeywell’s securities or using Honeywell’s securities to support margin debt. Hedging by directors, executive officers, employees on our restricted trading list, any employee in possession of material non-public information, or any of their designees is prohibited, and it is strongly discouraged for all other employees. For this purpose, hedging means purchasing financial instruments (including prepaid variable forward sale contracts, equity swaps, collars, and interests in exchange funds) or otherwise engaging in transactions that are designed to hedge or offset any decrease in the market value of Company stock held, directly or indirectly, by them, whether the stock was acquired as part of a compensation arrangement or otherwise. All employees, directors, and any of their respective designees are prohibited from engaging in short sales of Honeywell securities. Selling or purchasing puts or calls or otherwise trading in or writing options on Honeywell’s securities by employees, officers, and directors is also prohibited.

MANAGEMENT DEVELOPMENT AND COMPENSATION COMMITTEE REPORT The MDCC reviewed and discussed Honeywell’s Compensation Discussion and Analysis with management. Based on this review and discussion, the MDCC recommended thatto the Board of Directors includethat the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference in the Form 10-K for the year ended December 31, 2020.2021. The Management Development and Compensation Committee D. Scott Davis (ex officio member) member ) | | | | | | | | | | | | | Notice and Proxy Statement | 2022 | | 77 |

EXECUTIVE COMPENSATION TABLES SUMMARY COMPENSATION TABLE | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Named

Executive

Officer | Year | Salary | Stock Awards(2) | Option Awards(3) | Non-Equity Incentive Plan Compensation(4) | Change In Pension Value and Nonqualified Deferred Compensation Earnings(5) | All Other Compensation(6) | SEC Total Compensation(7) | | Non-SEC Total Annual Direct Compensation(8) | Darius Adamczyk Chairman and Chief Executive Officer | 2021 | | $ | 1,675,616 | | | $ | 14,486,389 | | | $ | 5,248,350 | | | $ | 3,910,000 | | | $ | 608,232 | | | $ | 171,533 | | | $26,100,120 | | | | $ | 20,566,195 | | | 2020 | | $ | 1,566,154 | | | $ | 9,113,476 | | | $ | 4,898,608 | | | $ | 2,508,000 | | | $ | 810,840 | | | $ | 178,203 | | | $19,075,281 | | | | $ | 18,086,238 | | | 2019 | | $ | 1,600,000 | | | $ | 8,612,506 | | | $ | 4,635,409 | | | $ | 4,065,000 | | | $ | 748,107 | | | $ | 864,082 | | | $20,525,104 | | | | $ | 18,912,915 | | Gregory P. Lewis Senior Vice President, Chief Financial Officer | 2021 | | $ | 830,493 | | | $ | 4,518,031 | | | $ | 1,643,520 | | | $ | 1,107,000 | | | $ | 215,089 | | | $ | 65,570 | | | $8,379,703 | | | | $ | 6,629,344 | | | 2020 | | $ | 753,711 | | | $ | 2,801,775 | | | $ | 1,502,982 | | | $ | 1,460,750 | | | $ | 254,487 | | | $ | 57,627 | | | $6,831,332 | | | | $ | 5,747,468 | | | 2019 | | $ | 749,808 | | | $ | 2,288,198 | | | $ | 1,222,904 | | | $ | 1,866,600 | | | $ | 185,939 | | | $ | 331,184 | | | $6,644,633 | | | | $ | 5,316,910 | | Anne T. Madden Senior Vice President, General Counsel | 2021 | | $ | 869,458 | | | $ | 4,518,031 | | | $ | 1,643,520 | | | $ | 1,159,000 | | | $ | 389,020 | | | $ | 80,362 | | | $8,659,391 | | | | $ | 6,720,309 | | | 2020 | | $ | 825,529 | | | $ | 2,801,775 | | | $ | 1,502,982 | | | $ | 758,000 | | | $ | 459,798 | | | $ | 87,544 | | | $6,435,628 | | | | $ | 5,888,286 | | | 2019 | | $ | 757,019 | | | $ | 2,288,198 | | | $ | 1,222,904 | | | $ | 1,970,500 | | | $ | 399,898 | | | $ | 69,977 | | | $6,708,496 | | | | $ | 5,370,121 | | Que Thanh Dallara(1) President and Chief Executive Officer, Honeywell Connected Enterprise | 2021 | | $ | 676,466 | | | $ | 3,860,000 | | | $ | 1,364,250 | | | $ | 804,000 | | | $ | 773 | | | $ | 52,160 | | | $6,757,649 | | | | $ | 5,367,608 | | | | | | | | | | | | | | | | | | | | Michael R. Madsen(1) President and Chief Executive Officer, Aerospace | 2021 | | $ | 737,052 | | | $ | 2,937,572 | | | $ | 1,094,610 | | | $ | 1,338,000 | | | $ | 726 | | | $ | 53,362 | | | $6,161,322 | | | | $ | 4,697,640 | | | | | | | | | | | | | | | | | | | |

(1)Ms. Dallara and Mr. Madsen are being reported as NEOs for the first time in 2022 (2021 compensation). (2)2021 Stock Awards represent the sum of three components (i) the annual PSU awards under the 2021-2023 Performance Plan at a fair value of $212.53 as of the grant date (March 15, 2021), (ii) the annual RSUs awarded at a grant date fair value of $202.72, determined using the average of the high and low stock prices of Honeywell stock on the grant date (February 12, 2021), and (iii) the incremental fair value from a pandemic-related modification to the financial metrics for the 2020-2022 PSU awards, which was made on March 15, 2021 (described on page 69 of this proxy statement). The 2021-2023 PSU award value was calculated based on the weighted average of (a) the fair market value of Honeywell stock on the date of grant for the 75% of the award tied to performance against internal metrics, and (b) a multifactor Monte Carlo simulation of Honeywell’s stock price and TSR relative to each of the other companies in the Compensation Peer Group, determined in accordance with FASB ASC Topic 718, for the 25% of the award with payout determined based on three-year TSR relative to the Compensation Peer Group. The value of the 2020-2022 PSU modification represents the incremental fair value of 2020-2022 PSUs originally granted in 2020, determined as of the March 15, 2021 modification date in accordance with FASB ASC Topic 718 for a Type III modification, with no offset for the forfeiture of the portion of the original award that became improbable of attainment due to the impacts from the COVID-19 pandemic. | | | | | | | | | | | | | | | | | | | | | | | | | | | | NEO | 2021-2023

Performance Stock Units | Restricted Stock

Units | 2020-2022

Performance Stock Unit Modification | Total SEC Reportable Stock Awards | | Mr. Adamczyk | | $ | 7,502,309 | | | $ | 2,229,920 | | | $ | 4,754,160 | | | $ | 14,486,389 | | | Mr. Lewis | | $ | 2,359,083 | | | $ | 689,248 | | | $ | 1,469,700 | | | $ | 4,518,031 | | | Ms. Madden | | $ | 2,359,083 | | | $ | 689,248 | | | $ | 1,469,700 | | | $ | 4,518,031 | | | Ms. Dallara | | $ | 1,955,276 | | | $ | 567,616 | | | $ | 1,337,108 | | | $ | 3,860,000 | | | Mr. Madsen | | $ | 1,572,722 | | | $ | 466,256 | | | $ | 898,594 | | | $ | 2,937,572 | |

(3)The 2021 Option Awards shown reflect the aggregate grant date fair value of the awards computed in accordance with FASB ASC Topic 718, using the Black-Scholes option-pricing model at the time of grant, with the expected-term input derived from a risk-adjusted Monte Carlo simulation of the historical exercise behavior and probability-weighted movements in Honeywell’s stock price over time. The 2021 annual Option Awards were awarded on February 12, 2021, with a Black-Scholes value of $32.10 per share at the time of grant. A discussion of the assumptions used in the valuation of option awards made in fiscal year 2021 may be found in Note 15 of the Notes to the Financial Statements in the Company’s Form 10-K for the year ended December 31, 2021. | | | | | | | | | 69

78 | |

| | | |Notice and Proxy Statement | 2021

| | | 2022 |

| | | 07 | | | EXECUTIVE

COMPENSATION TABLES

|

EXECUTIVE COMPENSATION TABLES

(4)SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Named Executive Officer | | Year | | | Salary(2) | | | Stock Awards(3) | | | Option Awards(4) | | | Non-Equity Incentive Plan Compensation(5) | | | Change In Pension Value and Nonqualified Deferred Compensation Earnings(6) | | | All Other Compensation(7) | | | SEC Total Compensation(8) | | | | | | | | | Non-SEC Total Annual Direct Compensation(9) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Darius Adamczyk Chairman and Chief Executive Officer | | | 2020 | | | $ | 1,566,154 | | | $ | 9,113,476 | | | $ | 4,898,608 | | | | $2,508,000 | | | | $810,840 | | | | $178,203 | | | | $19,075,281 | | | | | | | | | | | | $18,086,238 | | | | | 2019 | | | $ | 1,600,000 | | | $ | 8,612,506 | | | $ | 4,635,409 | | | | $4,065,000 | | | | $748,107 | | | | $864,082 | | | | $20,525,104 | | | | | | | | | | | | $18,912,915 | | | | | 2018 | | | $ | 1,571,154 | | | $ | 9,561,215 | | | $ | 3,185,655 | | | | $4,100,000 | | | | $595,082 | | | | $233,498 | | | | $19,246,604 | | | | | | | | | | | | $18,418,024 | | Gregory P. Lewis

Senior Vice President,

Chief Financial Officer | | | 2020 | | | $ | 753,711 | | | $ | 2,801,775 | | | $ | 1,502,982 | | | | $1,460,750 | | | | $254,487 | | | | $ 57,627 | | | | $ 6,831,332 | | | | | | | | | | | | $ 5,747,468 | | | | | 2019 | | | $ | 749,808 | | | $ | 2,288,198 | | | $ | 1,222,904 | | | | $1,866,600 | | | | $185,939 | | | | $331,184 | | | | $ 6,644,633 | | | | | | | | | | | | $ 5,316,910 | | | | | 2018 | | | $ | 578,981 | | | $ | 554,742 | | | $ | 591,250 | | | | $ 730,000 | | | | $103,155 | | | | $ 48,365 | | | | $ 2,606,493 | | | | | | | | | | | | $ 2,979,973 | | Anne T. Madden(1) Senior Vice President, General Counsel | | | 2020 | | | $ | 825,529 | | | $ | 2,801,775 | | | $ | 1,502,982 | | | | $ 758,000 | | | | $459,798 | | | | $ 87,544 | | | | $ 6,435,628 | | | | | | | | | | | | $ 5,888,286 | | | | | 2019 | | | $ | 757,019 | | | $ | 2,288,198 | | | $ | 1,222,904 | | | | $1,970,500 | | | | $399,898 | | | | $ 69,977 | | | | $ 6,708,496 | | | | | | | | | | | | $ 5,370,121 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Rajeev Gautam(1) President and Chief Executive Officer Performance Materials and Technologies | | | 2020 | | | $ | 768,394 | | | $ | 2,727,112 | | | $ | 1,468,726 | | | | $ 503,000 | | | | $403,986 | | | | $ 56,523 | | | | $ 5,927,741 | | | | | | | | | | | | $ 5,467,232 | | | | | 2019 | | | $ | 779,231 | | | $ | 2,621,868 | | | $ | 1,412,368 | | | | $ 976,000 | | | | $685,839 | | | | $ 55,857 | | | | $ 6,531,163 | | | | | | | | | | | | $ 5,789,467 | | | | | 2018 | | | $ | 755,247 | | | $ | 2,940,717 | | | $ | 979,110 | | | | $ 900,000 | | | | $ 6,799 | | | | $ 51,790 | | | | $ 5,633,663 | | | | | | | | | | | | $ 5,575,074 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | John F. Waldron(1) President and Chief Executive Officer Safety and Productivity Solutions | | | 2020 | | | $ | 704,769 | | | $ | 2,278,369 | | | $ | 1,224,652 | | | | $ 908,000 | | | | $190,879 | | | | $ 54,508 | | | | $ 5,361,177 | | | | | | | | | | | | $ 5,115,790 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) | Ms. Madden was not a NEO for the 2018 compensation year (2019 Proxy). Mr. Waldron is being reported as a NEO for the first time in 2021 (2020 compensation). Mr. Gautam has three years of compensation reported even though he was not a NEO in the 2019 Proxy statement (2018 compensation), as he was previously a NEO in the 2018 annual Proxy statement (2017 compensation).

|

(2) | Salary for 2020 reflects the impact of temporary reduction in base salary as a result of the COVID-19 pandemic. Includes one additional bi-weekly pay period due to payroll calendar.

|

(3) | 2020 Stock Awards represent the sum of (i) PSU awards under the 2020-2022 Performance Plan at a grant date fair value of $188.57 and (ii) RSUs awarded at a grant date value of $180.92, determined using the average of the high and low stock prices of Honeywell stock on the grant date. All 2020 Stock Awards were granted on February 14, 2020. The PSU award value was calculated based on the weighted average of (a) the fair market value of Honeywell stock on the date of grant for the 75% of the award tied to performance against internal metrics, and (b) a multifactor Monte Carlo simulation of Honeywell’s stock price and TSR relative to each of the other companies in the Compensation Peer Group, determined in accordance with FASB ASC Topic 718, for the 25% of the award with payout determined based on three-year TSR relative to the Compensation Peer Group.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | NEO | | 2020-2022 Performance Stock Units | | | Restricted Stock Units | | | Total Stock Awards | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mr. Adamczyk | | | $7,014,804 | | | | $2,098,672 | | | | $9,113,476 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mr. Lewis | | | $2,168,555 | | | | $ 633,220 | | | | $2,801,775 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ms. Madden | | | $2,168,555 | | | | $ 633,220 | | | | $2,801,775 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mr. Gautam | | | $2,111,984 | | | | $ 615,128 | | | | $2,727,112 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mr. Waldron | | | $1,753,701 | | | | $ 524,668 | | | | $2,278,369 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The 2020-2022 PSU2021 Non-Equity Incentive Plan Compensation value for each NEO, except Mr. Madsen, represents their annual ICP award values reflect the original grant date values. The subsequent pandemic-related adjustment to the plan financial metrics for the 2020-2022 PSUs,2021 plan year. 80% of the ICP award is determined using the pre-set formulaic methodology discussed beginning on page 60, and the remaining 20% is based on individual assessments determined by the MDCC discussed beginning on page 62. The amount for Mr. Madsen includes the sum of both his 2021 annual ICP award and his earned payout from Performance Plan cash units issued for the January 1, 2019 – December 31, 2021 cycle, that is required to be reported in the final year of the performance period under SEC rules, even though granted in 2019 and covering a three-year period. The following table provides the breakdown of the amounts reported as 2021 Non-Equity Incentive Plan Compensation for Mr. Madsen: | | | | | | | | | | | | | NEO | 2021 ICP Award | 2019-2021 Performance Plan Cash Award | Total Non-Equity Incentive Plan Compensation | | Mr. Madsen | $827,000 | | $511,000 | | $1,338,000 | |

(5)Represents (i) the aggregate change in the present value of each Named Executive Officer’s accumulated benefit under the Company’s pension plans from December 31, 2020 to December 31, 2021 (as disclosed in the Pension Benefits table on page 84 of this Proxy Statement) and (ii) interest earned in 2021 on deferred compensation that is considered “above-market interest” under SEC rules (as discussed on page 87). | | | | | | | | | | | | | | | | | | | | | | NEO | Change in Pension Value(a) | NQDC Interest(b) | Total Change in Pension

Value and Nonqualified

Deferred Compensation

Earnings | | Mr. Adamczyk | | $ | 605,743 | | | $ | 2,489 | | | $ | 608,232 | | | Mr. Lewis | | $ | 214,342 | | | $ | 747 | | | $ | 215,089 | | | Ms. Madden | | $ | 331,513 | | | $ | 57,507 | | | $ | 389,020 | | | Ms. Dallara | | $ | — | | | $ | 773 | | | $ | 773 | | | Mr. Madsen | | $ | — | | | $ | 726 | | | $ | 726 | |

(a)The change in aggregate pension value for Mr. Madsen was negative in 2021 ($8,126) resulting primarily from an increase in the discount rate from 2.50% as of December 31, 2020, to 2.87% at December 31, 2021. Under SEC rules, negative changes in pension values are not reported on the table. The value of benefits for the other NEOs, other than Ms. Dallara, was calculated as the lump sum under their pension formula as of December 31, 2021, which is unaffected by interest rates. Ms. Dallara is not eligible for a company sponsored pension plan. (b)Represents earnings under the Honeywell Excess Benefit Plan, Honeywell Supplemental Savings Plan, Honeywell Deferred Incentive Plan, or deferred RSU awards that are in excess of that determined using SEC market interest rates. (6)For 2021, All Other Compensation consists of the following: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | NEO | Matching Contributions(a) | Personal Use of Company Aircraft(b) | Security(c) | Excess Liability Insurance(d) | | Executive Physical/ Medical Services (e) | Total

Other

Compensation | | Mr. Adamczyk | | $ | 117,196 | | | $ | 43,040 | | | $ | 1,332 | | | $ | 1,515 | | | | $ | 8,450 | | | $ | 171,533 | | | Mr. Lewis | | $ | 58,057 | | | $ | 498 | | | $ | — | | | $ | 1,515 | | | | $ | 5,500 | | | $ | 65,570 | | | Ms. Madden | | $ | 60,833 | | | $ | 12,514 | | | $ | — | | | $ | 1,515 | | | | $ | 5,500 | | | $ | 80,362 | | | Ms. Dallara | | $ | 47,319 | | | $ | — | | | $ | — | | | $ | 1,515 | | | | $ | 3,326 | | | $ | 52,160 | | | Mr. Madsen | | $ | 51,546 | | | $ | — | | | $ | — | | | $ | 1,515 | | | | $ | 301 | | | $ | 53,362 | |

(a)Represents total Company matching contributions to each Named Executive Officer’s accounts in the tax-qualified Honeywell 401(k) Plan and the non-tax-qualified Supplemental Savings Plan. (b)For security reasons, Mr. Adamczyk is required by Company policy to use Company aircraft for all business and personal travel (requirement to use Company aircraft for specific personal travel may be waived at the discretion of Honeywell’s security personnel). Other NEOs may have access to available corporate aircraft for personal travel, from time to time, if approved by the CEO. The amount shown for each NEO represents the aggregate incremental cost of personal travel. This amount is calculated by multiplying the total number of personal flight hours by the average direct variable operating costs (e.g., expenses for aviation employees, variable aircraft maintenance, telecommunications, transportation charges, including but not limited to hangar and landing fees, aviation fuel, and commissaries) per flight hour for Company aircraft. (c)In accordance with the CEO security plan, represents the total paid by the Company in 2021 for expenses relating to personal residential security provided to protect Mr. Adamczyk. (d)Represents the annual premiums paid by the Company to purchase excess liability insurance coverage for each Named Executive Officer. (e)Represents cost of the annual executive physical covered by the Company (excess over insurance) and concierge medical services provided to Charlotte-based officers. (7)Represents total reportable compensation determined in accordance with SEC disclosure requirements. (8)Represents non-SEC supplemental information of Total Annual Direct Compensation (TADC) from the perspective of the MDCC (as discussed in the CD&A). For all years, this column excludes the amounts reflected in the (i) Change in Pension Value and Deferred Compensation Earnings, and (ii) All Other Compensation columns of the Summary Compensation Table (SCT). For 2021, this column also excludes the 2019-2021 performance cash award to Mr. Madsen (see footnote 4), which was madeawarded in February 2021, is2019 and considered an award modification that will resultpart of TADC by the MDCC in incremental value for these awards that will2019 but required to be reflected as 2021 compensationreported on the Summary Compensation Table as 2021 compensation (at the end of the three-year performance period) under SEC rules, and the incremental reportable value from the March 2021 modification to the 2020-2022 PSUs granted to the NEOs in 2020, which the next annual Proxy Statement.(4) | The 2020 Option Awards shown reflect the aggregate grant date fair value of the awards computed in accordance with FASB ASC Topic 718, using the Black-Scholes option-pricing model at the time of grant, with the expected-term input derived from a risk-adjusted Monte Carlo simulation of the historical exercise behavior and probability-weighted movements in Honeywell’s stock price over time. The 2020 annual Option Awards were awarded on February 14, 2020, with a Black-Scholes value of $21.41 per share at the time of grant. A discussion of the assumptions used in the valuation of option awards made in fiscal year 2020 may be found in Note 16 of the Notes to the Financial Statements in the Company’s Form 10-K for the year ended December 31, 2020.

|

MDCC viewed as a pandemic-related realignment to the intended grant date value of the PSU awards reported on the Summary Compensation Table as compensation for 2020. For 2020, this column also excludes the 2018-2020 performance cash award to Mr. Lewis, which was awarded in 2018 and considered part of TADC by the MDCC in 2018 but required to be reported on the Summary Compensation Table as 2020 compensation (at the end of the three-year performance period) under SEC rules. For 2019, this column excludes the 2017-2019 performance cash awards to Mr. Lewis and Ms. Madden that were awarded in 2017 and considered part of TADC by the MDCC in 2017 but required to be reported on the Summary Compensation Table as 2019 compensation (at the end of the three-year performance period) under SEC rules. | | | | |

| | | Notice and Proxy Statement | 2021

| | 70

|

| | | 07 | | | EXECUTIVE

COMPENSATION TABLES

|

(5) | The 2020 Non-Equity Incentive Plan Compensation value for each NEO, except Mr. Lewis, represents their annual ICP award for the 2020 plan year. 80% of the ICP award is determined using the pre-set formulaic methodology discussed beginning on page 53, and the remaining 20% is based on individual assessments determined by the MDCC discussed beginning on page 55. The amount for Mr. Lewis includes both his 2020 annual ICP award and his earned payout from cash-units issued for the January 1, 2018 – December 31, 2020 cycle of the Performance Plan, that is required to be reported in the final year of the performance period under SEC rules, even though granted in 2018 and covering a three-year period. The following table provides the breakdown of the amounts reported as 2020 Non-Equity Incentive Plan Compensation for Mr. Lewis:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | NEO | | 2020 ICP

Award | | | 2018-2020

Performance

Plan Cash

Award | | | Total

Non-Equity

Incentive Plan

Compensation | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mr. Lewis | | | $689,000 | | | | $771,750 | | | | $1,460,750 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(6) | Represents (i) the aggregate change in the present value of each Named Executive Officer’s accumulated benefit under the Company’s pension plans from December 31, 2019, to December 31, 2020 (as disclosed in the Pension Benefits table on page 76 of this Proxy Statement) and (ii) interest earned in 2020 on deferred compensation that is considered “above-market interest” under SEC rules (as discussed on page 79).

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | NEO | | Change in Pension Value(a) | | | NQDC Interest(c) | | | Total Change in Pension Value and Nonqualified Deferred

Compensation Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mr. Adamczyk | | $ | 805,492 | | | $ | 5,348 | | | $ | 810,840 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mr. Lewis | | $ | 253,033 | | | $ | 1,454 | | | $ | 254,487 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ms. Madden | | $ | 421,241 | | | $ | 38,557 | | | $ | 459,798 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mr. Gautam | | $ | 397,106 | (b) | | $ | 6,880 | | | $ | 403,986 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mr. Waldron | | $ | 189,939 | | | $ | 940 | | | $ | 190,879 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | The reported change in aggregate pension value for Mr. Gautam includes the impact of a decrease in the discount rate from 3.22% as of December 31, 2019, to 2.50% at December 31, 2020. The value of benefits for the other NEOs was calculated as the lump sum under their pension formula as of December 31, 2020, which is unaffected by interest rates.

|

| (b) | Excluding the impact of the decrease in discount rate during 2020, the change in pension value for Mr. Gautam was ($104,669).

|

| (c) | Represents earnings under the Honeywell Excess Benefit Plan, Honeywell Supplemental Savings Plan and Honeywell Deferred Incentive Plan that are in excess of that determined using SEC market interest rates.

|

(7) | For 2020, All Other Compensation consists of the following:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | NEO | | Matching Contributions(a) | | | Personal Use of Company Aircraft(b) | | | Security(c) | | | Excess Liability Insurance(d) | | | Executive

Physical/

Medical

Services (e) | | | Total Other Compensation | | | | | | | | | | | | | | | | | | | | | | | | | | | | Mr. Adamczyk | | $ | 109,631 | | | $ | 35,489 | | | $ | 22,418 | | | $ | 1,515 | | | $ | 9,150 | | | $ | 178,203 | | Mr. Lewis | | $ | 52,760 | | | | — | | | | — | | | $ | 1,515 | | | $ | 3,352 | | | $ | 57,627 | | Ms. Madden | | $ | 57,787 | | | $ | 22,739 | | | | — | | | $ | 1,515 | | | $ | 5,503 | | | $ | 87,544 | | Mr. Gautam | | $ | 53,788 | | | | — | | | | — | | | $ | 1,515 | | | $ | 1,220 | | | $ | 56,523 | | Mr. Waldron | | $ | 49,334 | | | | — | | | | — | | | $ | 1,515 | | | $ | 3,659 | | | $ | 54,508 | |

| (a) | Represents total Company matching contributions to each Named Executive Officer’s accounts in the tax-qualified Honeywell 401(k) Plan and the non-tax-qualified Supplemental Savings Plan.

|

| (b) | For security reasons, Mr. Adamczyk is required by Company policy to use Company aircraft for all business and personal travel (requirement to use Company aircraft for specific personal travel may be waived at the discretion of Honeywell’s security personnel). Other NEOs may have access to available corporate aircraft for personal travel, from time to time, if approved by the CEO. The amount shown for each NEO represents the aggregate incremental cost of personal travel. This amount is calculated by multiplying the total number of personal flight hours by the average direct variable operating costs (e.g., expenses for aviation employees, variable aircraft maintenance, telecommunications, transportation charges, including but not limited to hangar and landing fees, aviation fuel, and commissaries) per flight hour for Company aircraft.

|

| (c) | In accordance with the CEO security plan, represents the total paid by the Company in 2020 for expenses relating to personal residential security provided to protect Mr. Adamczyk.

|

| (d) | Represents the annual premiums paid by the Company to purchase excess liability insurance coverage for each Named Executive Officer.

|

| (e) | Represents cost of the annual executive physical covered by the Company (excess over insurance) and concierge medical services provided to Charlotte-based officers.

|

(8) | Represents total reportable compensation determined in accordance with SEC disclosure requirements.

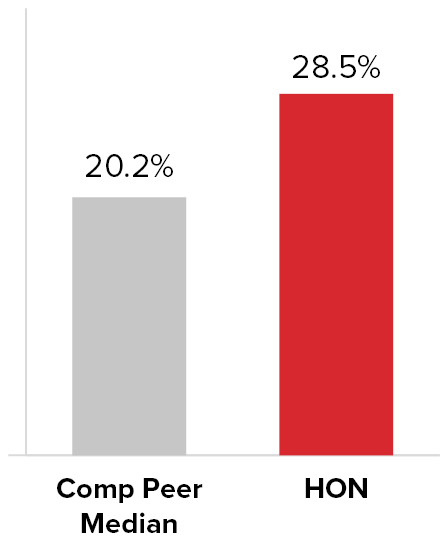

|